Do commodity traders have the information they need to tackle the ever increasing complexity?

In my previous blogpost Global insight is key to remain competitive in Commodity Trading, I argued that the commodity trader has adopted the role of a merchant, focusing on managing the value chain and gaining more profit out of this chain. In this blogpost I will share a deeper insight in the most important changes that are taking place in the demand, supply and logistics operations. These changes are the main drivers for the ever-increasing complexity of the value chain and force traders to cope with a tremendous amount of flexible variables.

Change in Demand and Supply

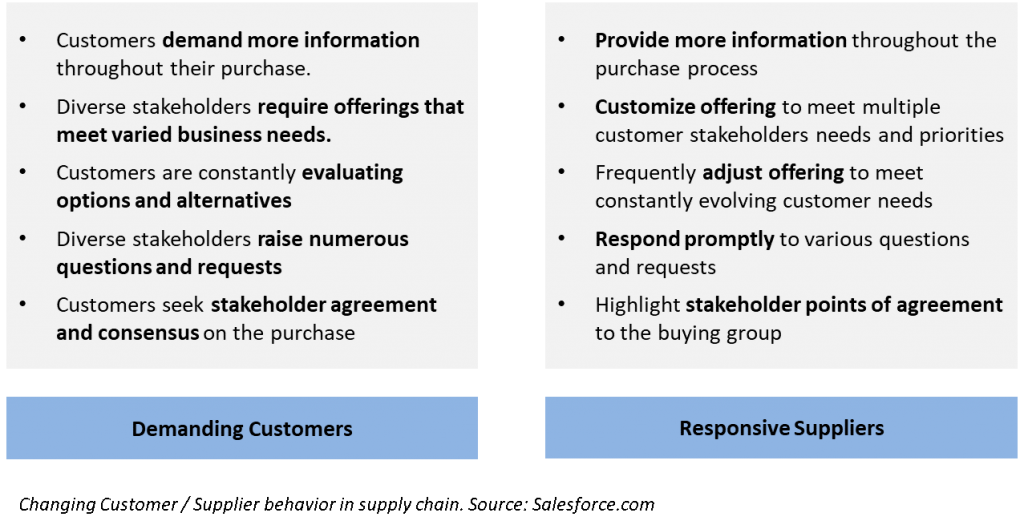

The structure of demand and supply has always been divers and complex, specific in areas like food and energy due to irregular delivery and quality, fluctuating production or harvesting uncertainties. On top of this and recently, suppliers become more demanding. To secure their profit and minimize risk, they have become more responsive to customer and market development and as an example create complex supply contracts. These supply contracts involve complex pricing; clauses on minimal – maximum deliveries with bonus & malus and even contract farming on the basis of an agreement between producers and traders.

Complex pricing structures have become standard for customers as well including product and service levels. As an example: to build and protect their ‘brand’ customers define a minimal quality to be delivered. And demand materials only from specific suppliers. However, not only the customer causes increased complexity; export legislation and procedures, quality certificates, traceability requirements, all result in increased logistic complexity. This complexity intensifies the information exchange between trader, customer, transport company and a variety of institutions responsible for national regulations.

The value chain, that has become a more prominent area of the commodity trader, transforms into a portfolio optimization problem. Traders need to take supply and demand structure and specification into account together with market developments, logistic aspects, regulation and legislation.

The need for information

These developments indicate that commodity trading has become a complex operation. Traditional traders might get lost in complexity of variabilities, regulations and diverse product and service levels. Closing contracts has become the job of lawyers and risk analysts using what-if scenarios to match perceived risk with pricing. All to facilitate to manage the value chain between responsive suppliers and demanding customers.

To optimize the value of the supply chain and manage risks end-to-end, insight into the value chain is essential. Only then lawyers and risk analysts can optimize their risk-pricing balance and create value for the trader.

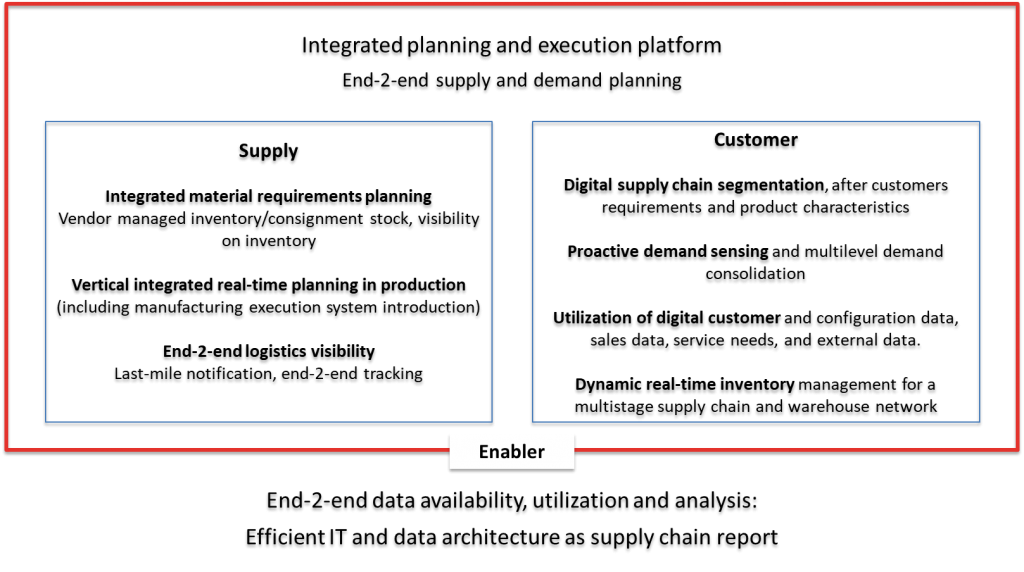

Efficient IT and Data architecture is required

Insight into the value chain with increasing complexity and volatility as stated above has become a real challenge for commodity traders. It’s not only the gathering of data that creates the challenge but putting it in the right place and getting the right information out of the data causes CIO’s and IT-managers severe headaches. But looking into the near future the role of merchant of the commodity trader and even becoming the “Enabler” requires a to support this role in the supply chain.

This blog is a second part in a trilogy on main changes in commodity trading; supply chain development and the relation to required IT and data architecture.

Blog part 1: Global insight is key to remain competitive in Commodity Trading

JD Edwards Commodity Trading & Risk Management

In this brochure we take a look at commodity trading, existing software solutions and a fully integrated commodity trading and ERP solution that you may not already know. With this solution – JD Edwards Commodity Trading & Risk Management (CTRM) – you have the right software for trading, management and calculations, you make processes transparent and you mitigate risks.

Reference material:

- The Challenges Ahead for Supply Chains, McKinsey Global Survey Results.

- Industry 4.0: How digitization makes the supply chain more efficient, agile, and customer-focused, PWC.

- Sales Complexity: Why Sales Jobs Are More Complex Than Ever, Salesforce UK

Author: Arjan Meijdam

Consultant CTRM